AACS bookkeeping service

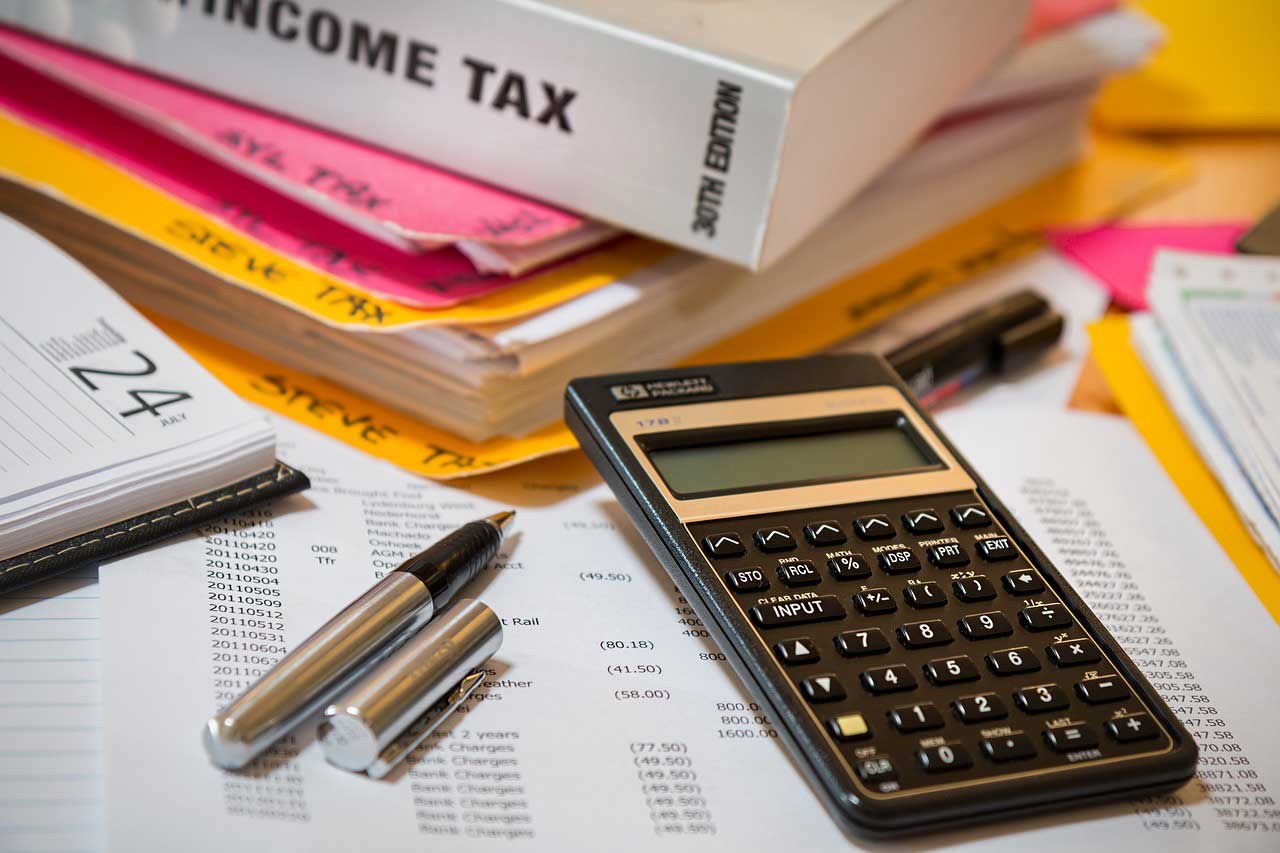

Bookkeeping service

AACS provides proper bookkeeping service based on Vietnamese accounting standard, VAS.

Proper financial statement-based decision making is important for business operations.

By outsourcing the bookkeeping agent to accounting staff, it becomes easy to manage budget planning, inventory management, employee salary and insurance payments, etc. based on correct financial statements.

When paying corporate income tax in Vietnam, it is necessary to know the taxable amount based on the financial statements based on Vietnamese accounting standards.

It should also be borne in mind that if the financial statements cannot be prepared correctly, there is a risk of compliance.

When expanding to Vietnam, we recommend that you outsource to a specialized organization rather than establishing your own accounting department until you are accustomed to Vietnam's institutional system, accounting standards, and laws.

Various services

Providing income statement and balance sheet

・Fixed asset register

・Bank adjustment chart

・Weekly, quarterly, monthly, yearly financial analysis

Benefits of requesting bookkeeping

・Eligible organization of books and documents

・Preparation of legal financial statements based on Vietnamese accounting standards

・ Storage of financial statement data in AACS (optional)

・Accounting window with Japanese parent company

Receipt agency business

Fee (VAT not included)-

Monthly bookkeeping material creation

-

Corporate income tax return

-

VAT filing

-

Personal income tax return

Please quote the exact amount.

Representative office 1800USD ~

Establishment of corporation 3000USD ~

Registration change 400USD ~

From 500USD

Monthly bookkeeping material creation

Corporate income tax return

VAT filing

Personal income tax return

Information on audit procedures

Explanation of audit report

Japanese test 1st grade

Correspondence of professional interpreters with more than 10 years of experience